Accountex 2025: AI in Finance – From Future Buzz to Today’s Toolkit

I recently spent an insightful couple of days at Accountex London, and one thing was abundantly clear: Artificial Intelligence in the finance and accounting world has truly come of age. The buzz was palpable, with what felt like every other stand showcasing AI-powered tools and software. It’s evident that AI is rapidly moving from a future-gazing concept to a practical, embedded capability within modern financial software.

For us at WrightCFO, serving dynamic businesses in the tech, media, creative, and not-for-profit sectors, this evolution isn’t just interesting – it’s transformative. The conversations at Accountex have shifted decisively beyond basic automation. We’re now seeing AI designed to deliver genuine strategic value: predictive insights, smart recommendations, and advanced data analysis that can empower leadership.

AI: Your Strategic Co-Pilot, Not Your Replacement

A key theme, and one that resonates strongly with our ethos, was the emphasis on AI supporting people, not replacing them. Major vendors are focusing on “trust and control,” ensuring that human expertise remains central. This is crucial. For CFOs, and indeed for the businesses we partner with, the integrity of financial data and the ability to understand how conclusions are reached are paramount. The idea is to elevate finance professionals, allowing us to spend less time on manual processing and more on forward-looking strategy and advisory – shaping the future of the organisations we support.

A Spectrum of Solutions: From Operational Efficiency to Strategic Powerhouses

Walking the floors of Excel London, we saw a fascinating array of AI applications. On one hand, well-established players like Sage, with its Sage Intacct platform and AI assistant Sage Copilot, and Wolters Kluwer, with its CCH Tagetik solution, showcased sophisticated AI aimed at enhancing strategic CFO functions. Think advanced cash flow forecasting, robust scenario planning for business valuation, and deep, real-time financial reporting. These tools are clearly geared towards businesses looking for comprehensive, strategic financial leadership.

On the other hand, many excellent tools, including those from Xero, Intuit QuickBooks, and FreeAgent, are increasingly embedding AI to drive operational efficiencies, particularly for small to medium-sized businesses. This might involve AI streamlining bank reconciliations, improving expense management, or offering initial predictive cash flow insights.

This isn’t a case of one being “better” than the other; it’s about the right fit for the specific needs and scale of a business.

What Does This AI Advancement Mean for Your Business?

For the tech, media, creative, and not-for-profit organisations we work with, these AI developments offer exciting possibilities:

- Smarter Cash Flow Management: AI can provide more accurate cash flow forecasting by analysing vast amounts of data and identifying trends a human might miss. This is invaluable for project-based tech and creative firms managing fluctuating income streams, or for not-for-profits needing to meticulously plan around grant cycles and donations.

- Deeper, Faster Insights from Your Data: Imagine real-time, dynamic reports and dashboards that don’t just tell you what happened, but also offer predictive insights into why it happened and what might come next. For fast-paced tech and media companies, this agility in decision-making is a significant competitive advantage. For not-for-profits, enhanced reporting can translate into greater transparency for stakeholders and a clearer demonstration of impact.

- More Robust Strategic Planning & Valuation Support: AI-driven scenario modelling allows businesses to test different strategies and understand potential financial outcomes with greater clarity. Whether you’re a tech start-up modelling investment rounds, a creative agency assessing the profitability of new service lines, or an NFP planning for expansion, AI can provide a more solid data foundation for these critical decisions. The detailed financial models and trend analysis offered by some AI tools also provide crucial inputs for business valuation exercises.

A Few AI Finance Tools on Our Radar

Beyond the major platforms, the event and wider industry discussions highlight a growing number of specialised AI tools. Here are a few examples that businesses and their finance leaders might find noteworthy:

- Swoop Funding: This platform uses AI to help businesses find and apply for suitable funding, whether loans, grants, or equity. It also offers tools for cost-saving and cash flow optimisation, acting like a virtual finance expert for SMEs.

- Xbert: An AI-powered tool designed for accountants and bookkeepers that analyses accounting data (from Xero, QBO etc.) to detect errors, anomalies, and compliance risks, helping to ensure data integrity and providing advisory insights.

- Fathom: Known for its powerful financial analysis, reporting, and forecasting capabilities. Fathom helps businesses gain deeper insights from their financial data and create detailed three-way (P&L, Balance Sheet, Cash Flow) forecasts, with features like ‘Smart Prediction’ aiding the process.

- Sage Copilot: As mentioned earlier, this AI assistant embedded within Sage products is a prime example of how AI is becoming integral to core accounting platforms, helping automate tasks, generate insights, and manage finances more effectively.

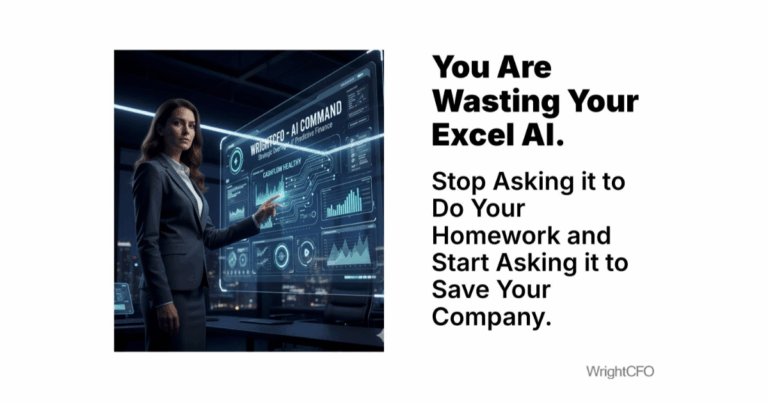

- Datarails: An FP&A (Financial Planning & Analysis) platform that incorporates AI, including a natural language assistant, to help finance teams with budgeting, forecasting, and generating insights from their existing Excel models and other data sources.

These are just a few examples of the diverse tools emerging, each designed to address specific financial challenges with the power of AI.

The Human Touch in an AI-Driven World

Whilst the technology is impressive, its successful adoption hinges on more than just software. It requires a clear understanding of what you want to achieve, a robust approach to data quality (as AI is only as good as the data it’s fed), and a willingness to adapt and learn.

This is where fractional CFOs like us at WrightCFO come in. We see our role evolving alongside these technologies. We’re here to help you cut through the noise, identify which AI tools (if any) are right for your specific circumstances, and ensure they are implemented in a way that genuinely empowers your strategic goals. For businesses in our specialist sectors – tech, media, creative industries, and not-for-profit – we bring an understanding of your unique challenges and opportunities, helping to tailor these powerful new tools to your world.

The AI revolution in finance is here, and it’s gathering pace. Is your business ready to benefit from its potential?

If you’d like to discuss how these advancements could impact your organisation, or how a fractional CFO can help you understand and adapt to these changes, please do get in touch. We’d love to hear from you.

This article was originally published here on LinkedIn on 21st May, 2025