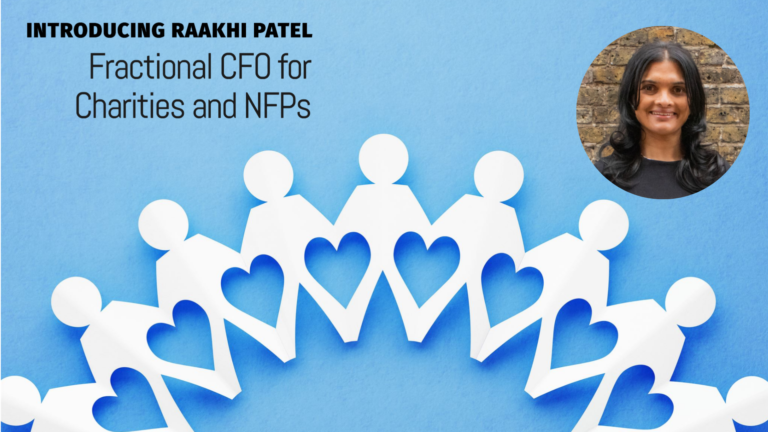

Meet Sophie Wright, Founder WrightCFO

Sophie Wright is a qualified CIMA management accountant with nearly 20 years of experience and she is the Director and Founder of WrightCFO. This month Sophie answers some key questions to give you an insight into how WrightCFO came to be and offers her advice to budding entrepreneurs.

Tell us a little bit about your professional background.

I have worked within finance for the past 21 years. I started at the very bottom, as a purchase ledger clerk for a car dealership, before moving on to undertake an accounts assistant position at a technology firm, whilst studying AAT in the evenings. Upon graduating I moved into advertising, and management and continued to study in my free time, completing my CIMA exams. Once I qualified, I worked in New York in my first Finance Director role for a digital media company. After a year, I returned to London where I became Finance Director for a global advertising agency. Career wise, my next move was to found WrightCFO.

What made you decide to start your own business ?

WrightCFO all started when I had my two children (10.5 months apart- that’s right), and lost my job whilst I was on my second maternity leave (too familiar a story).

Following that I took up a 3 month temporary role, 5 days a week. It was a long commute and I had time to reassess, not just the job but everything. I started to research CEOs and business owners of SMEs local to me, in South West London, who did not have a Finance Director and invited them for coffee to discuss whether they would consider hiring me. My aim at this point was to be close to home and gain a role with more flexibility. However, it quickly became clear that in many cases, people didn’t want a full time Finance Director on their books. They did not have enough work for one, and they couldn’t afford the high salary but it was clear that a Finance Director would bring huge amounts to value to their business. It was when one business owner said, “I could afford one day a week though” that the light bulb went off ! I had a solution! What these SMEs needed was a Part-Time FD, in bite-size chunks. This way they use what they can afford and still get that senior board level Finance Director as part of their management team.

So in 2014, I created WrightCFO Ltd, a provider of Part-Time Finance Directors for SMEs.

What was your first year in business like?

The first year I was doing all the Finance Director work myself. Once I got to grips with how it all works, I made the decision to expand and move from being essentially a freelancer to a business owner with growth objectives. I took on more consultants and placed them into businesses. And the rest, as they say, is history. We continue to grow by satisfying the need for SMEs to have access to a professional Finance Director and providing work for Finance Directors who have decided to make the move from larger corporate careers to working as flexible, Portfolio Finance Directors for SMEs.

How would you define entrepreneurship?

I am an avid Peter Drucker fan. I think he said it best when he said: “The entrepreneur always searches for change, responds to it, and exploits it as an opportunity.”

I completely agree with that definition. I would add that an entrepreneur is also always looking to solve a problem.

What would you say are the top skills that needed to be a successful entrepreneur/business owner?

Resilience has got to be top of the list when it comes to skills needed to be a business owner. You’ve got to be willing to fail and try new things to see what works and what doesn’t. If you don’t have enough bounce in you, you won’t make it. I like to think of Tigger from Winnie the Pooh, just keep bouncing back. If something doesn’t work, try something else.

My second skill would be that you need to be able to handle some risk (without being stupid about it). Some measured risk… not huge, jumping off buildings type of risk.

What technologies or tools have made your life easier as a business owner?

I write all my notes on Evernote now, rather than carry around several little notebooks which can get lost, (or coloured on by little people.) There is the added advantage that they are actually legible this way.

Automation is really important, so depending on what it is that you do, try and find something to be able to automize processes. Buffer for example can be used to plan and schedule all your social media posts. You can get direct bank feeds straight into your accounting system which saves time as well.

Outsourced part-time support is also really helpful. And I don’t just mean outsourcing part-time Finance Directors. I have found it very useful to have support for instance from a virtual PA who does my social media planning. It takes some weight off me so I can concentrate on other areas. I’ve also used outsourced HR support which has been a huge help.

Are there different challenges that women entrepreneurs/business owners face, and if so, how can do you think we can address this?

When I was working as an employee the biggest bias I found in terms of being a women, was related to having children. I used to have an employer that always joked, “I hope you’re not going to have any kids – you’re not allowed ha ha”. So, when I found myself ready to start a family, I found such comments annoying to say the least. After having children, but before setting up WrightCFO, I remember going for a job interview and the light in the eyes of the employer dimmed very quickly once I mentioned I had been on mat leave. They were no longer interested.

In terms of being a business owner, it’s been very interesting. I can count on both hands, the number of times, business owners called and said, I called you (and not a competitor) because you have many women FD’s in your business which is unusual. One business (a competitor but in another geographical area) called specifically to ask why there were so many women Finance Directors on our website when they had only men on theirs. I replied with, “how come you don’t?”

Whatever your gender, age, race, religion. Whatever you are, it really doesn’t matter. Are you good at what you do? Do you bring value to your customers? Are you paid fairly for the work you’ve done? That is what matters.

What would be your best piece of advice to someone looking to start their own business?

Watch your spending like a hawk! Negotiate on price for everything you buy. I would also advise registering for VAT right away. Many would disagree with me here, because you don’t actually have to register until you are turning over £85K in a year. Not being VAT registered is the easier route as you do not have to worry about submitting your returns on time. However, in the beginning, you are spending set up costs. You’re buying IT equipment, maybe a website and some hosting, and other things. When you are registered for VAT you can claim all your VAT back. So in the first little while, until you start earning revenue, HMRC will pay you back 20% of your vateable purchases. When you’re watching your pennies, this extra cash is very useful indeed. Don’t be lazy- register yourself, do the returns and get some cash back on your set up costs.

If you want to discuss more about the world of part time Finance Directors or entrepreneurship with Sophie then please get in touch to arrange a chat.